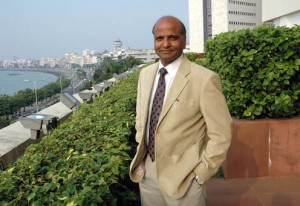

By: Lalit Kumar Jain, Chairman, CREDAI

Track2Realty Exclusive: A McKinsey report to the Government of India on cost of approval had clearly pointed out that the costs incurred on account of various approvals could constitute anything up to 40 per cent of the sale value. Such is the enormity of the problem of approvals and that the challenge of negativity that we suffer from.

Track2Realty Exclusive: A McKinsey report to the Government of India on cost of approval had clearly pointed out that the costs incurred on account of various approvals could constitute anything up to 40 per cent of the sale value. Such is the enormity of the problem of approvals and that the challenge of negativity that we suffer from.

By the government’s own admission, the real estate sector in India constitutes about 11 per cent of the GDP and as former Finance Minister and now President of India Pranab Mukherjee said, “A large number of transactions in the real estate sector are not reported on account of very high levels of property transaction taxes, commonly in the form of stamp duty.”

To quote Mukherjee, “Investment in property is a common means of parking unaccounted money and a large number of transactions in real estate are not reported or are under-reported. This is mainly on account of very high levels of property transaction taxes, commonly in the form of stamp duty. High transaction taxes in property are one of the biggest impediments to the development of an efficient property market.”

That was well said. We sincerely hope that the government takes some positive steps. But the recent budgetary announcements have not brought any cheer to the sector to help it perform well. On the contrary, we witness a punish-the-builder attitude prevailing in the corridors of power.

We were extremely disappointed as the Finance Minister missed out on affordable and rental housing and banking reforms in his budget speech.

While we are happy that P Chidambaram accepted the suggestion for home loan interest incentives for sub-Rs 25 lakh buyers, we were expecting a lot more.

Project finance is yet another major problem and here the negative weightage given by the RBI to builders’ image (read brand). Our grouse with the Finance Minister is that he has not given any directions to the RBI.

Developers’ life would become much easier if we are given the infrastructure status and we are happy that Union Housing Minister Ajay Maken has supported this.

Revival of real estate is a must for rejuvenating the economy since the sector supports over 200 other industries. Every rupee invested in real estate sector, contributes to addition of 78 paise to GDP. Pompous it may sound. In other words, brand real estate contributes to brand India.

All talk about affordable housing, but we do precious little about achieving it. We have suggested workable means. The nation urgently needs to scale up the delivery of housing which can be achieved with the help of proven technology that can be imported from aboard.

The Finance Minister seems to have gone for revenue generation through the high tax route and not by the growth-oriented economy.

CREDAI has been campaigning for Special Housing Zones on lines of SEZ, but sadly there has been no movement on this. We strongly feel that the extension of facilities that are given to SEZ be granted to real estate and that could easily help in making affordable housing a reality.

At the end, can we sincerely hope that conditions that are conducive for conducting a business with honesty would be created by all concerned? No prudent developer wants to be in business to earn ill will!