Indian real estate many lessons unlearnt with the Chinese property market in general and Evergrande fiasco in particular. Track2Realty takes a look at the two largest property markets of the world and the collective failures to address the fault lines.

“Off the Record” discussions are not very candid in a tight-lipped business like real estate in India. The developers more often than not try to convince, confuse and even corrupt the journalists in order to influence peddle their side of the story. Fake narrative has hence gained ground in the real estate business and no one knows how it actually helps the developers in their sales channel or brand recall.

It has hence been a different experience for me when a leading developer recently admitted that China’s Evergrande fiasco is no different than what Indian real estate market has already faced. The phenomenal rise & imminent fall of developers like Unitech, Jaypee, HDIL and Amrapali has not faded from the public memory in this part of the world. He went on to the extent of forecasting many other property developers’ collapse in the days to come. Many are fiscally stressed and just delaying the inevitable end of rags to riches story.

Within the built environment of the Indian real estate there is still denial about too many parallels between the Indian and the Chinese real estate. Many even believe that the Indian economy is not that real estate dependent as the Chinese economy. Even when admitting the crisis in Indian real estate, it is diplomatically wrapped in the developer’s justification of not learning any lessons on part of the Indian developers.

The two largest real estate markets of the world, by sheer size, are today grappling with what could easily be termed as the existential crisis. Indian real estate has historically been known to not learn any lessons, whether with the Indian or Chinese property developers’ mistakes.

The lessons and parallel between the Indian and the Chinese property markets are nevertheless writ large on the wall:

Inventory overhang and holding

The latest industry narrative is that the property prices are imminent to rise due to the rise in input cost. In a market where the large share of inventory is ready or near ready, the argument doesn’t hold ground. Can the buyers absorb the already over-valued property in a stagflation economy of uncertainty? Won’t this keep the fence sitting buyers away from the property market, instead of instilling FOMO (Fear of Missing Out) in them? The fact of the matter is that instead of putting on an urgency button to offload the inventory, the developers are getting into an oft-repeated loop of inventory holding with price appreciation.

Expansion at the cost of fiscal closure

RERA was supposed to make sure that the Escrow Account is a full proof mechanism of funds not being diverted. However, beyond the limitations of RERA as a watchdog body, the fact lies that the developers in both India and China market have this tendency to over-borrow and over-leverage with their fancy expansion rather than being focused on the financial closure of the project. A large number of developers with multiple stuck-up projects waiting for the buyers and funds are testimony of this mindset of still living in a booming market. When under construction property has turned from hot cake to stale bread, it is imperative for the developers to finish off the handful of projects rather than struggling financially for the execution of multiple projects.

Denial till exposed

How many developers in India or China have ever accepted their fault lines, fiscal stress, inability to repay to the lenders or the unhappy buyers waiting for years? They live in denial till completely exposed. If today it is China’s Evergrande, earlier it had been multiple Indian developers. But denial is so vehement across the stakeholders that any cross question is referred to as “Spreading Negativity.”

Policy as equity

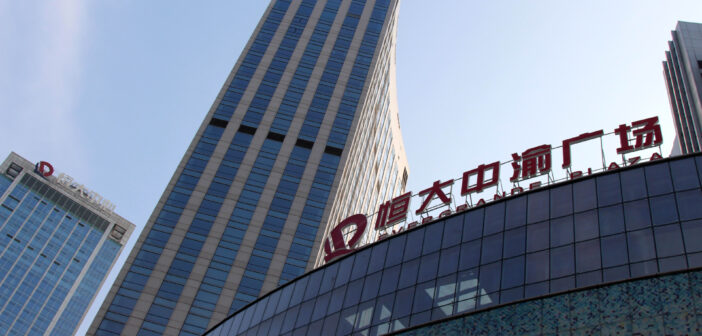

Policies of any given country shape the outcome of the businesses across the board and the business of real estate is no exception. Evergrande for a good number of years enjoyed the long ropes of Chinese policy facilitating real estate as an engine of economic growth. But when the Chinese Government started tightening the noose, it is not just Evergande but a number of property developers that are suffocating. Evergrande is in the news due to its sheer size.

The Indian developers too are today enjoying the easy lending, lower cost of borrowing, an accommodating regulatory regime and, as the Supreme Court curtly said in its order against Supertech, costly & lengthy litigation that keeps the consumer activism in check. I am not even talking about the real estate developers whose only equity & expertise lies in liaising with the powers to be, the source of off-the-books funding and policy facilitating.

Won’t it come to a painful end sometime sooner than later?

Growth beyond execution capabilities

A drive through Shenzhen and Noida-Greater Noida resembles the same. The ghost city look & feel of these two places point out to the common problem of supply far exceeding demand. However, the very fact that many of the developers in these markets have opted for growth beyond their execution capabilities also brings to the table the root of the property market malaise called Stuck Up Projects.

Evergrande too finds itself in the same trap despite its gigantic size. Will the Indian developers learn this lesson? It doesn’t seem a sound business strategy when I find the debt-ridden realty players justifying that if they have INR 16,000 crore debt then they also have saleable inventory of INR 12,000 crore; hence net debt is very low. The problem with such a calculation is that the developer is living with a misplaced assumption that the market is desperate to absorb his saleable inventory and/or till the time inventory is sold off the lenders are not asking for interest payment.

Overlooked C-SAT Score

Last, but not the least, the critical link for a long-term business and brand goodwill has always been missing in both China and India. C-SAT or the Consumer Satisfaction Score has never been assessed in the two largest property markets of the world. Reason: The pace of property appreciation was compensating for the quality of the housing, or the lack of it. Till the time the property prices were appreciating the buyer too was not vocal. The developer had the upper hand to return the money and make even bigger profit with resale of the same inventory. Housing had turned out to be a trading commodity then. Not anymore! The appreciation is today lower than other financial instruments and the lack of quality delivery & handover has put C-SAT Score lowest in the collective consciousness of the buyers.

Will China’s Evergrande failure force the Indian developers this time around to rethink their business strategy? Unfortunately, they are still living in denial and trying best with their influence peddling through false narratives. As this “Off the Record” developer admits: “The market can’t absorb the price rise due to a hike in the input cost. The developers can’t reduce their profit margins either. Only way is to compromise with the quality of materials, fittings & fixtures.”

Can somebody admit it “On the Record” please?

Ravi Sinha

#RaviTrack2Media

Track2Realty is an independent media group managed by a consortium of journalists. Starting as the first e-newspaper in the Indian real estate sector in 2011, the group has today evolved as a think-tank on the sector with specialized research reports and rating & ranking. We are editorially independent and free from commercial bias and/or influenced by investors or shareholders. Our editorial team has no clash of interest in practicing high quality journalism that is free, frank & fearless.

Subscribe our YouTube Channel @ https://bit.ly/2tDugGl