Provident Housing secures INR 1,150 crores investment from HDFC Capital

Provident Housing, a wholly owned subsidiary of Puravankara Limited has made a…

Provident Housing, a wholly owned subsidiary of Puravankara Limited has made a…

Third-party logistics players (3PL) continued to be the top occupiers of industrial and warehousing space, contributing to over 40% in the total warehousing demand. 3PL space uptake was driven by healthy activity in Chennai particularly. The city accounted for about 43% of the overall 3PL activity in the top five cities. Interestingly, at the Pan-India level, retail players accounted for 16% of the demand during the quarter, followed by engineering and automobile players with 12% share each.

The residential sector is currently undergoing a bullish phase, characterised by a convergence of factors that foster an extremely favourable ecosystem. As we progress into 2024, we anticipate that both sales and new property launches will sustain the sector’s buoyancy. Despite the potential challenges posed by escalating land costs and limited funding options for early-stage projects, the robust underlying market fundamentals are expected to propel residential activity well above the average trend witnessed in the previous five years.

Global Capability Centres (GCCs) accounted for a share of one-third in the overall India office leasing in Jan- Mar ’24. Within the GCCs space take-up, E&M companies contributed to over one-fourth share, followed by automobile firms. Bangalore led the chart for GCC leasing, boasting a 60% share, followed by Hyderabad with 26% and Delhi-NCR with 9%. Notably, 38% of the large-sized deals (exceeding 100,000 sq. ft.) were secured by GCCs during this period, underscoring their significant impact on the office leasing landscape.

The overall leasing by luxury brands across the formats stood at 0.6 mn. sq. ft. in 2023, at almost 170% Y-o-Y growth. While High Streets constituted a 45% share in the overall luxury retail leasing in 2023, luxury brands’ stores in Malls followed at 40% and standalone stores accounted for the remaining 15%. This surge in leasing has been accompanied by the entry and expansion of various international luxury fashion, watch and jewellery brands across different locations. The eight cities tracked for leasing include Delhi-NCR, Mumbai, Bangalore, Kolkata, Pune, Ahmedabad, Chennai, and Hyderabad.

The report of an impending housing recession in the US housing market is a worrying factor for a section of analysts in India. As per the reports coming out of the US market, the pricing remains firm but the sales have slowed down. As per a report by the NAR (National Association of Realtors), the home sales have slowed down for six consecutive months in July. Track2Realty reports.

While other developers aspiring to go global are tying up with international brands, PNC Menon, founder and Chairman Emeritus of Sobha Group believes in organic growth of the brand. In an exclusive interview with Ravi Sinha at his Dubai office, he explains how Sobha has the inherent resilience to succeed anywhere in the global market. Focus on quality & don’t break the law is his mantra of global brand leadership.

Ramneek Patel, an MNC executive in Gurugram is on a company leased accommodation and the HR is deducting INR 40,000 per month for his rented apartment. Now that the Goods & Service Tax (GST) has been imposed for rental residential units to companies, he has been told by the company that the said liability will be passed on to the employees living in company leased apartments. They can otherwise find an apartment on their own.

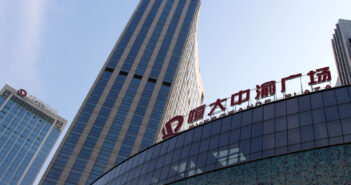

Within the built environment of the Indian real estate there is still denial about too many parallels between the Indian and the Chinese real estate. Many even believe that the Indian economy is not that real estate dependent as the Chinese economy. Even when admitting the crisis in Indian real estate, it is diplomatically wrapped in the developer’s justification of not learning any lessons on part of the Indian developers.

It is the story of a debt ridden real estate company that is financially overleveraged; gone beyond execution capabilities; has multi-city penetration; is into multiple businesses; and the promoters are just delaying the inevitable. The developer that you instantly recall is China’s Evergrande. It’s the talk of the town across the built environment of global real estate today. But wait! Has India not been witness to its own Evergrande moment (though on a smaller scale) in the past? Track2Realty speaks to cross section of industry analysts.