By: Neeraj Bansal, Director, Risk Consulting, KPMG India

Year 2011 was a challenging year for the Indian real estate sector. It was a year which brought to the mainstream need for policy level changes with respect to land acquisition and compensation; transparency and fairness in customer dealings by developers; hardening of interest rates; high pressure on developer margins with increasing costs of acquiring land and construction materials; and shortage of skilled and experienced project management resources. With this backdrop the real estate sector is now bracing itself to face the opportunities and challenges of the coming year.

Year 2011 was a challenging year for the Indian real estate sector. It was a year which brought to the mainstream need for policy level changes with respect to land acquisition and compensation; transparency and fairness in customer dealings by developers; hardening of interest rates; high pressure on developer margins with increasing costs of acquiring land and construction materials; and shortage of skilled and experienced project management resources. With this backdrop the real estate sector is now bracing itself to face the opportunities and challenges of the coming year.

In the coming year(s) the real estate sector will focus on newer construction technologies; green/environment friendly building; and further enhancing utilities for the end users.

Residential market to boom in 2012

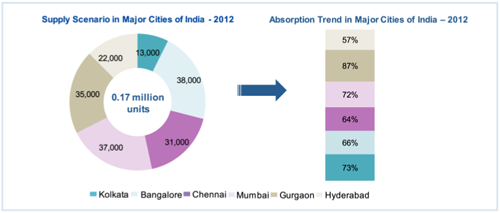

Since 2010, the residential sector has been on a strong growth trajectory and with increasing urbanization the momentum is expected to continue. Strong demographic mix and increasing salary levels will be the key triggers for growth of the residential market in 2012. Salaried individuals in the age group of 30 to 35 years will emerge as the biggest contributors for demand in the residential category. This category of buyers has in past also been the main contributor to the growth of residential category. It is expected that by 2012, about 0.17 million units of supply will be available in the six major cities across India[1],[2]. Of this unit supply, Tier I cities such as Chennai, Mumbai, Gurgaon and Kolkata accounts for 66 percent of the supply, while the remaining 34 percent is accounted by Tier II cities such as Bangalore and Hyderabad.

Note: 0.17 million is the sum total of supply in the mentioned cities

Note: 0.17 million is the sum total of supply in the mentioned cities

Source: KPMG Analysis

Further, during the same period, it has been observed that Gurgaon and Kolkata are expected to have the maximum absorption trend. Also, about 75 percent of the total unit supply in 2012 will be accounted by 2 BHK and 3 BHK units. During the realty boom, a higher composition of 4 BHK and other premium segments are usually expected; however, developers are conscious of the importance of smaller units in generating higher volumes and continuity in sales pattern.

[1] KPMG Analysis

[2]The figure is based on the number of ongoing projects in the location and expected number of apartments by each developer.