Knight Frank Research

Market forces of demand and supply are the most potent determinants of price and the developments in the real estate industry during year 2011 is the latest example. The stalemate between the buyers and developers is weakening as developers attempt to salvage their position by adopting to the last resort of reducing property prices although in a quiet manner for transactions on table or where a large upfront payment is agreed.

Market forces of demand and supply are the most potent determinants of price and the developments in the real estate industry during year 2011 is the latest example. The stalemate between the buyers and developers is weakening as developers attempt to salvage their position by adopting to the last resort of reducing property prices although in a quiet manner for transactions on table or where a large upfront payment is agreed.

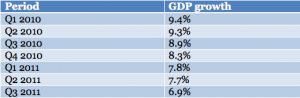

Demand for real estate is a derived demand and thus the state of economy has a direct bearing on the sector. Since the slowdown in 2008-09 on the backdrop of global financial crisis, the Indian economy picked up really well in 2009 and 2010. However, a closer look at the quarterly GDP numbers indicates a receding growth sequentially for each of the quarters since Q1 2010 when the economy grew by 9.4%. The latest number for Q3 2011 indicates that the economy’s growth rate has come down to 6.9%.

Table 1: India GDP growth trend

Source: GOI

While the world economy was facing pressure of an imminent double dip recession and some European economies risked defaulting on their debt, inflation remained the primary concern for the Indian economy since the beginning of the year. While the central bank’s efforts centered on taming inflation, the fallout was high interest rate and tight credit scenario resulting in to faltering economic growth. Rising corporate governance issues and menace of corruption ensured that decisions on major reforms were delayed. While investment slowed on account of high interest rate and hiatus on major infrastructure projects, government’s ability to increase consumption, as witnessed during the 2008 downturn, was reduced because of rising fiscal deficit. The unfolding of these developments has resulted in a compromised economic growth and the real estate industry has taken the biggest hit. Thus, the year 2011 can be referred as a dull year on account of slack transaction activity, few project launches and stagnant property prices.

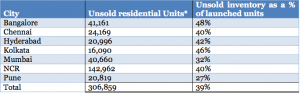

While residential property price appreciated between 10% – 30% in 2010 across major cities like Mumbai, NCR, Bangalore and Chennai, it has declined by up to 10% in 2011. The pace of new project launches has severely been crippled in 2011. During 2010, 3,61,098 residential units were launched across the top 7 cities of Mumbai, NCR, Pune, Kolkata, Bangalore, Chennai and Hyderabad. However, in 2011 only 1,72,856 units were launched. This is a decline of 52% from the last year. Moreover, of the total housing inventory pertaining to the under construction projects, 39% or 3,06,859 units are lying unsold. A substantial portion of this unsold inventory belongs to the NCR market.

Table 2: State of residential property market

Source: Eyestate

*Note: Residential projects with a size of INR 30 crores and above have been considered.

Mumbai property market was even worse recording a sharp decline in the number of new project launches in 2011. Just about 19,470 units were launched in 2011 in comparison to the 54,968 housing units that were launched in the previous year. This decline of 65% fewer launches highlights the lack of buyer interest in the extremely expensive Mumbai property market. Moreover, 40,660 housing units or 32% of the inventory is lying unsold in the city. Although the situation remained grim throughout the year, there was a stalemate between the buyers and the builders, who remained in a denial mode with respect to lowering the prices.

Commercial office space demand, which is driven mainly by the service sector industries like BFSI and IT/ITES, remained muted in 2011. Rentals in the top 7 cities remained under pressure as corporates trimmed hiring plans resulting in to reduced office space requirement. Of the total office stock of 367 mn.sq.ft. in these cities, 24% or almost 89 mn.sq.ft. remains vacant. NCR, Pune, Chennai and Kolkata have a high proportion of vacant stock followed by Mumbai and Bangalore. Hyderabad office market is relatively better placed in terms of the unoccupied stock.

The landmark reform with respect to the sector was the draft real estate regulation bill. The proposed bill is the first such bill at the central level which will directly regulate the real estate sector and adjudicate any dispute between the buyer, promoter and government authority. The bill attempts to overcome the shortcomings of the existing system in the real estate market where buyer’s interest is frequently ignored by the promoter as well as the government. The bill tries to identify these problem areas and fix time bound responsibility on the promoters to disclose certain necessary information regarding their projects in order to bring in greater level of transparency. It would be a great effort if this bill improves focus on development of the sector than merely regulating it.

Another reform proposed in 2011 but could not take off is the FDI in multi brand retail. There is restriction on foreign investment in retail sector. Foreign participation in the retail sector should bring in efficiency in the procurement and supply chain operations thereby reduce wastage and offer lower prices to consumers. The proposal to relax the restriction on entry of foreign players by allowing 51% FDI in multi-brand retail and 100% in single brand retail will greatly benefit the real estate industry, which has been in pressure since the beginning of the global financial crisis.