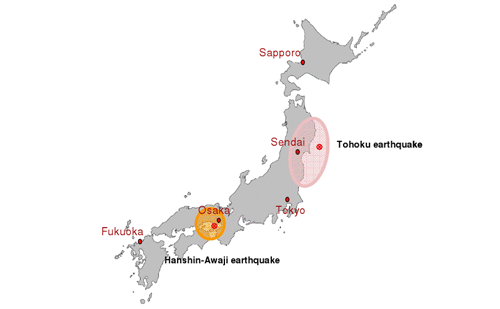

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April. While major damages occurred in the Tohoku district, the direct damage to Greater Tokyo was limited. However, disruptions in the supply chain due to damaged production plants in the Tohoku district, as well as electricity shortages following the nuclear plant crisis in Fukushima, have impacted the economy of the entire nation. The damage generated by this major earthquake is expected to surpass that of Hanshin-Awaji Earthquake in 1995.

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April. While major damages occurred in the Tohoku district, the direct damage to Greater Tokyo was limited. However, disruptions in the supply chain due to damaged production plants in the Tohoku district, as well as electricity shortages following the nuclear plant crisis in Fukushima, have impacted the economy of the entire nation. The damage generated by this major earthquake is expected to surpass that of Hanshin-Awaji Earthquake in 1995.

The earthquake inevitably has led to a hiatus in the investment market. In some cases this was caused by the cancellation of funding due to the turmoil in financial markets immediately following the earthquake, but in most cases, it was because of the need for a physical damage survey to assess the impacts of the earthquake. Not all, but most foreign investors have expressed positive views towards investment in Japan and have flagged potential opportunities and their intention to increase their presence in the market.

As to the debt market, foreign lenders have not demanded an increase in the risk premium for Japan in the form of wider JGB spreads. Nor are lenders warning us of any appreciable change in domestic financing conditions, now or over the medium term.

Outlook on the office market in Tokyo

In the short term, rental values in the Tokyo office market are expected to fall as a result of the slowdown in demand caused by the deterioration in corporate profits following the earthquake, as well as the relocation and withdrawal of multinational companies. Thereafter, as the economy emerges on the back of demand related to the reconstruction of the Tohoku district, we expect office demand to pick up, and in part supported by affordable rental values, leasing activity in the office market to recover. As to rental values, we expect Grade A office buildings to lead the recovery, with a 3-5% decrease in 2011 and a 5-10% increase in 2012. The recovery of Grade B buildings is expected to lag.

From the investors’ perspective, Japan is the third-largest economy in the world with a mature real estate market, and is considered as a primary destination for investment in global asset allocation. Recently, the real estate markets in the Asian countries – in particular China – have attracted attention as destinations for investment. These opportunities come with a high return based on strong growth projections, but are often high-risk. Therefore, the diversification of risks is a further contributing factor in favour of the long-term appeal of Japan. However, it is hard to expect the capital value to increase for a short term period as investors are adopting a wait-and-see approach.