By: Ben Breslau

Global office vacancy declines to 14.1 percent as leasing activity moves into cyclical upswing

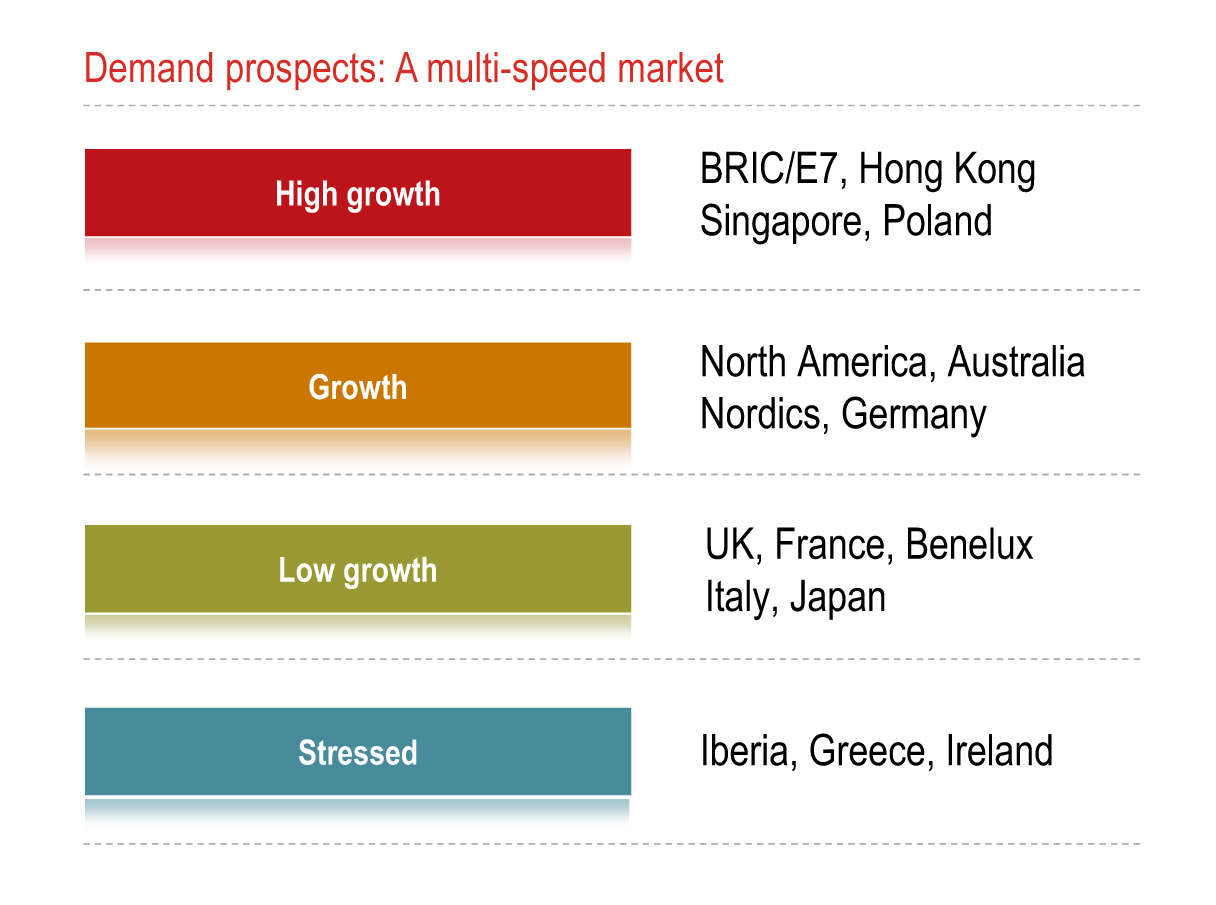

Corporate confidence is boosting activity in top tier office markets around the world, leading to accelerating early cycle rental growth and robust capital value growth in prime assets, especially where new quality supply is limited, according to Jones Lang LaSalle’s inaugural, quarterly Global Office Outlook report. The firm’s new global report series tracks and forecasts how global economic conditions impact property leasing, capital markets and occupier conditions throughout Asia Pacific, Europe, Middle East and Africa (EMEA) and the Americas. The report points to several hot spots emerging with high growth prospects including the E7 (Brazil, India, China, Russia, Indonesia, Mexico and Turkey), Hong Kong, Singapore and Poland.

Corporate confidence is boosting activity in top tier office markets around the world, leading to accelerating early cycle rental growth and robust capital value growth in prime assets, especially where new quality supply is limited, according to Jones Lang LaSalle’s inaugural, quarterly Global Office Outlook report. The firm’s new global report series tracks and forecasts how global economic conditions impact property leasing, capital markets and occupier conditions throughout Asia Pacific, Europe, Middle East and Africa (EMEA) and the Americas. The report points to several hot spots emerging with high growth prospects including the E7 (Brazil, India, China, Russia, Indonesia, Mexico and Turkey), Hong Kong, Singapore and Poland.

For the first time since the global financial crisis, downside risks are being outweighed by the improving business optimism although recent global events have the capacity to dent this optimism. Jones Lang LaSalle’s Global Office Outlook report shows that market demand and leasing activity are back in a cyclical upswing, fueled by improving economic growth, renewed corporate confidence, and strengthened balance sheets and prospects of increasing spending and hiring associated with real estate investment. Global office vacancy rates have reached a plateau and edged downward across all three regions in late 2010. The global office vacancy rate now stands at 14.1 percent.

“Despite some obvious risks, the global economic outlook remains positive,” said Ben Breslau, Managing Director of Jones Lang LaSalle Americas Research. “Coming off the heels of a robust 2010, economic growth is expected to accelerate further in the later half of 2011 and into 2012, but the strength of the recovery and expansion remains remarkably uneven geographically. Expect office market demand and the potential for rent growth to mirror the uneven economic outlook, with leverage ranging from landlord favorable in trophy CBD assets in coastal gateway markets to tenant favorable in many non-core and suburban locations.”

Prior to the Japan earthquake and tsunami, Asia Pacific was moving ahead strongly with the largest declines in vacancy, improving occupancy levels, and attractive conditions for investment. Jane Murray, Asia Pacific Head of Research, added, “Regional momentum should continue led by robust growth in China and India. The ultimate impact on the large Japanese economy and real estate market and its trading partners regionally and globally will not be known for some time.”

Regional outlook

Americas: “The coming year will be best characterized by an uneven upswing and cautious optimism,” said Ben Breslau, Managing Director of Jones Lang LaSalle Americas Research. “North America is expected to accelerate modestly, with continuing improvement in select prime markets such as Washington DC, Midtown Manhattan, and San Francisco. United States vacancy levels are down year-over-year and will close below 18 percent in 2011. Additionally, the Canadian office market will tighten with accelerated rent growth in 2011; while Sao Paulo’s strong economic growth is translating into healthy office demand.”

Asia Pacific: With Japan’s devastation aside, property market fundamentals continue to improve across Asia Pacific, assisted by strengthening business conditions and solid corporate hiring. “Regional net absorption is expected to further increase in 2011, and vacancy is expected to fall in most major markets. However in a few markets that have large impending supply, such as Singapore and some Indian cities, vacancy rates are expected to rise over 2011,” added Murray.

EMEA: Business sentiment is at its highest level since 2007 in Europe with occupier and investment transaction volumes recovering strongly. “Occupiers remain cautious with deals still driven largely by lease events and consolidation. We are now in a rental growth phase – led by a limited number of markets – but it could be beyond 2014 in some markets before 2007 market peaks are witnessed again,” said Grant Fitzner, Head of Jones Lang LaSalle EMEA Research. “The UK, France, Germany and some of the Nordic markets, particularly Sweden are paving the road with improved market fundamentals and dominating investor interest. We are also watching events in the Middle East and North Africa very closely. As well as obvious impacts on local business sentiment internally, any impact on oil prices will filter through to capital markets volumes externally.”

Capital markets 2011 outlook

Investment volumes for office properties reached US$155 billion across the globe in 2010, and the 2011 global total is expected to rise to the US$190 billion range as capital value growth encourages property owners to put more product on the market.

Capital value growth for prime assets in Tier I office markets has been increasing robustly, led by Hong Kong, London, Paris and Moscow. Value growth is expected to continue in most markets in 2011, pushed by rental uplift.

Corporate occupier 2011 outlook

Corporate occupiers will be actively focused in 2011 on additional market moves that accommodate anticipated increases in hiring, the need to access new workers amid a renewing ‘war for talent,’ and the necessity to make workspace more productive.

The author is the Managing Director of Jones Lang LaSalle Americas Research.