Supertech 1st developer to face its Victims’ Forum

News Point: In an unprecedented move, Outlook for Social Change…

News Point: In an unprecedented move, Outlook for Social Change…

News Point: With 315 MSF office and 39 MSF mall…

News Point: Supertech is a case study in flouting norms…

A house hunt has always been tedious and challenging for anyone in this country. Imagine the travails of finding 100 apartments to live in. Yes! This has been the thought process when the editorial team of Track2Realty embarked on a journey to find 100 best housing projects relevant for investment in the year ahead.

Under the UP Government’s scheme to develop sports-centric projects in the state, Supertech Limited has been allotted land to develop sports-centric development, Sports Village, in Knowledge Park, Greater Noida (West). The project is dedicated to the sports enthusiasts who want to learn sports while living there.

The IT/ITeS sector has clearly been driving corporate real estate in the country; and consequently, much of the development in this space is being propelled by IT and back-office demand for workspaces, as per CBRE’s India report – Real Estate & Workplace Strategies of Shared Services Occupiers.

Immediately after the earthquake in Delhi-NCR a builder sends a group WhatsApp message that says: Our project in Noida is NCR’s 1st and only earthquake resistant structure with seismic zone V compliance approved by IIT Bombay. Possession next month.” It does not go down well in the collective consciousness as an impression gains ground that the developers are evaluating the opportunity cost in times of a natural calamity. This message nevertheless raises more questions than it tries to answer that the given project is earthquake complaint.

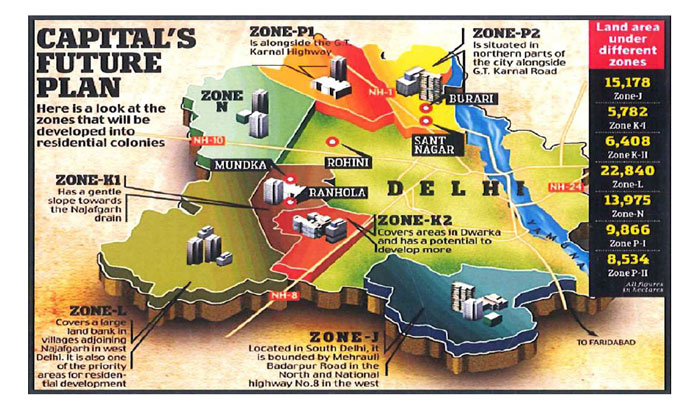

Why do you buy a house in Noida, Noida Extension, Ghaziabad, Faridabad or even non-descript & hard-to-commute locations of NCR when you work in Delhi? If affordability is not the issue, won’t you prefer to live in the capital Delhi and not the satellite cities of NCR?

In the evaluation of sustainability of a housing market, the absorption of office space is the prime indicator across the world. After all, it is the economic activity and the job magnet that fuels the demand for new houses. The city of Mumbai has always been blessed on that count due to demand and supply dynamics.

When Roshan Abbas, a property broker operating out of Mira Road of Western Suburb, claimed that the region would be the catalyst of housing revival in the Mumbai Metropolitan Region (MMR), many thought this to be claims of a broker glorifying his catchment area. Some of the critics even dismissed it as another marketing stunt on the eve of the festive season of Navratra.