43-54 billion REIT eligible commercial property in India

News Point: With 315 MSF office and 39 MSF mall…

News Point: With 315 MSF office and 39 MSF mall…

The IT/ITeS sector has clearly been driving corporate real estate in the country; and consequently, much of the development in this space is being propelled by IT and back-office demand for workspaces, as per CBRE’s India report – Real Estate & Workplace Strategies of Shared Services Occupiers.

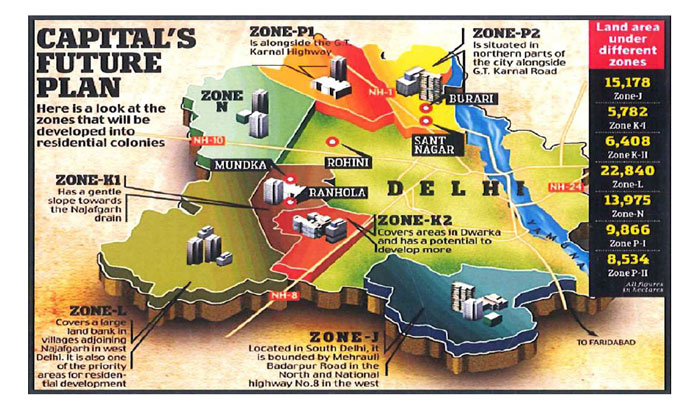

Why do you buy a house in Noida, Noida Extension, Ghaziabad, Faridabad or even non-descript & hard-to-commute locations of NCR when you work in Delhi? If affordability is not the issue, won’t you prefer to live in the capital Delhi and not the satellite cities of NCR?

In the evaluation of sustainability of a housing market, the absorption of office space is the prime indicator across the world. After all, it is the economic activity and the job magnet that fuels the demand for new houses. The city of Mumbai has always been blessed on that count due to demand and supply dynamics.

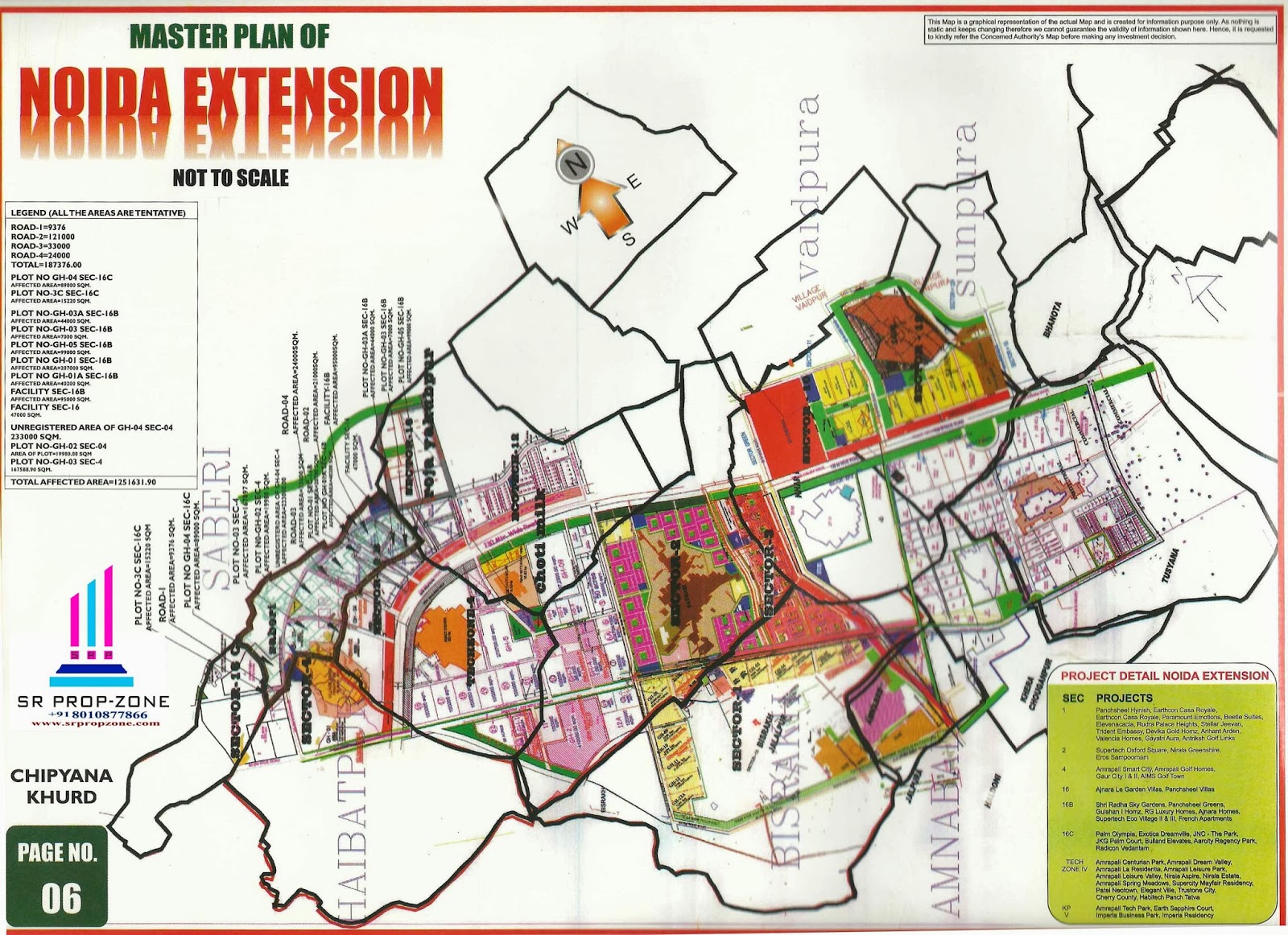

No other residential micro market of India has arguably weathered as many challenges and controversies as Noida Extension. Its inception as a separate zone, other than Noida & Greater Noida, did lend credence to conspiracy theories against the farmers that culminated into land acquisition litigation. Since then it has been a sordid saga of project delivery uncertainties and homebuyers endless wait; not to speak of the additional charges levied as against the compensation amount hiked to the farmers.