Real estate markets are inherently vulnerable to prolonged periods where prices deviate from their fundamental value. The features that contribute to this deviation are imperfect information, suboptimal financial markets and supply rigidities. Imperfect information causes buyers to either overestimate or underestimate the fundamental value of real estate assets; the lack of sophisticated financial instruments such as shorts, futures and options prevents these deviations from being countered by investors and prolongs the over or underestimation. And last, long construction lags prevent a quick response from developers in such conditions. All this keeps prices vulnerable for a longer period and may increase the risk of an asset price bubble in the sector.

Real estate markets are inherently vulnerable to prolonged periods where prices deviate from their fundamental value. The features that contribute to this deviation are imperfect information, suboptimal financial markets and supply rigidities. Imperfect information causes buyers to either overestimate or underestimate the fundamental value of real estate assets; the lack of sophisticated financial instruments such as shorts, futures and options prevents these deviations from being countered by investors and prolongs the over or underestimation. And last, long construction lags prevent a quick response from developers in such conditions. All this keeps prices vulnerable for a longer period and may increase the risk of an asset price bubble in the sector.

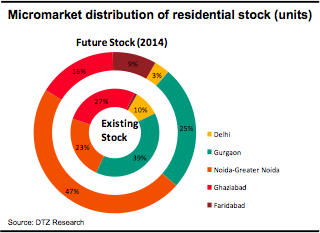

This is a normal property cycle, and Delhi NCR is not immune to it. Imperfect information is rampant, although the media and dedicated research houses are doing their bit to improve the situation. Financial products that can help bring the market to its fundamental equilibrium are not currently available. And long construction lags are a reality that can only be removed marginally over time. But that does not mean that residential real estate markets cannot be studied fundamentally. Supply from developers and prices have followed a pattern based on fundamental assumptions and movements. The objective of this report is to examine these assumptions and price movements across some of the key segments of the Delhi NCR residential real estate market.